Some of these firms are even dot com survivors, and for decades have been able to keep themselves afloat amid various technological trends.Īnd sure, a fair share of newer companies have entered the public mainstage. Think Google, Meta, Microsoft, Amazon, and so on. Most notable is that most of the biggest players in the AI industry are longtime Silicon Valley behemoths, and have been working on developing the technology for a while. Per the WSJ, the ten biggest stocks in the S&P 500 right now make up more than a third of the total market, and this "concentration of leadership," as Mike Edwards, the deputy chief investment officer at the firm Weiss Multi-Strategy Advisers, told the WSJ, is "the market story that rhymes most with the internet bubble."īut while the comparisons between these economic times certainly shouldn't be ignored, there are some big differences as well. "Investors can benefit from innovation-led growth, but must be wary of overpaying for it."Īnother striking similarity between AI and dot com? Market concentration.

"There's a huge boom in AI - some people are scrambling to get exposure at any cost, while others are sounding the alarm that this will end in tears," Kai Wu, founder and chief investment officer of Sparkline Capital, told the WSJ. Investors keep biting, and, per the WSJ, the stocks keep rising - shares of Nvidia, for example, the chipmaker whose GPUs are sought after for AI projects, have tripled in value this year, while tech giants like Meta, Microsoft, and Amazon, which are all working on AI tech, have seen their stock prices skyrocket by 154 percent, 65 percent, and 35 percent, respectively.Īnd yet, though the tech is impressive, its true value - nevermind path to profitability - is still wildly unclear. Or, for that matter, have yet to even introduce a discernible product.Ĭompany leaders, meanwhile, continue to make sweeping claims about the transformational power of their tech, which they consistently argue could save the world, destroy it, or - conveniently - both. And when the vast majority of these ventures ultimately fell short, they failed, swallowing roughly $5 trillion in fundraising as they sank into VCs are all too happy to pour massive amounts of cash into a growing constellation of AI firms, even those that have yet to turn a profit. Hungry to cash in on a new, lucrative age of technology, venture capitalists took to throwing large sums at companies that, though they made all the right promises about their ability to change the world, had yet to actually prove their viability.

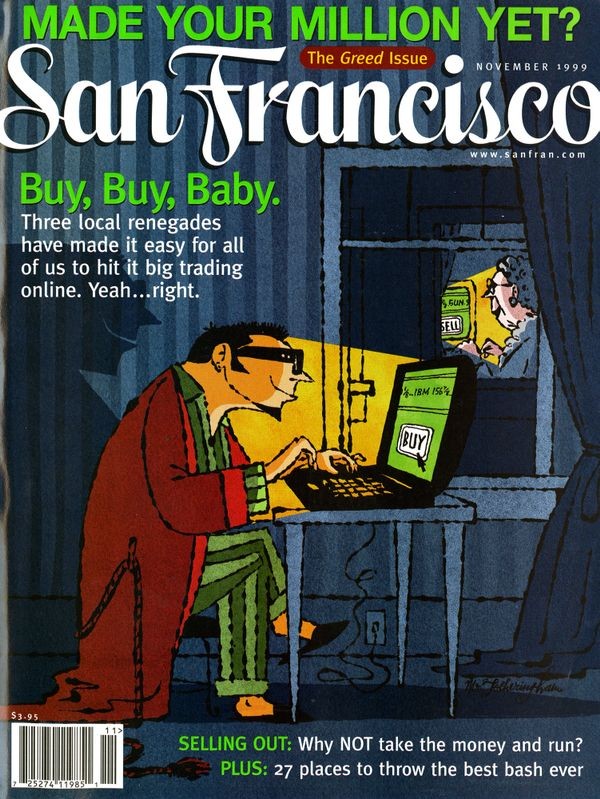

The dot com bubble - and subsequent crash - was an era defined by a gold rush-like frenzy and inflated valuations. As the AI industry's market value continues to balloon, experts are warning that its meteoric rise is eerily similar to that of a different - and significant - moment in economic history: the dot com bubble of the late 1990s.

0 kommentar(er)

0 kommentar(er)